Financials for a startup

The early stages are a critical time for a startup when the team works hard and nobody thinks about the startup financials. It is supported by the “spend less” mentality. But everyone understands that sooner or later it would be nice to start accounting.

In these conditions, it is so easy to get carried away with product creativity and leave no room for commercial pragmatism, and this is a big mistake.

Why do founders need to keep records?

Nine out of ten startups in the USA fail, and almost 30% of these failures are due to the fact that projects cannot earn their living anymore. If the founders had high-quality financial reporting, they would know exactly the dynamics of their sales, how quickly and for what exactly they are burning money as well as how much money is still left. Based on this data it is much easier to make correct forward-looking business decisions including the right timing for the next round of investment attraction.

This approach helps to avoid panic meetings with investors in an attempt to raise “at least something” as soon as possible. Such situations are recognized almost immediately and have a negative effect on the negotiating position of projects, the company evaluation, and the probability of attracting investments in general. The damage dealt to your company this way can be compared to the misunderstandings between team members because of the uneven startup equity structure.

Money is readily given to those who do not need it urgently.

When a project starts spending funds raised from outside, the investor has a quite natural desire to know where and how much money is being spent.

It is much better when the project already has generated reporting by this stage. Also, it should be gradually upgraded along with the growth of the business. You know you have failed to organize this process when reporting is being collected on the go and only because the investor asked. This situation will always lead to mistakes and difficulties in communication. Moreover, a new potential investor interested in the deal will conduct the so-called due diligence – a complex audit of the company.

It includes a cost check to determine how much and on what the startup has already spent funds and what it has managed to achieve. The team won’t need to fantasize and come up with how much and where they spent throughout the entire period of their existence if it has a working accounting system from the very beginning.

Accounting is a kind of tool for tracking the health of a startup that should be used even when there are no obvious problems. It’s very much like a regular visit to the dentist for prevention. With a systematic visit to the dentist, most of the problems can be solved rather painlessly.

Accounting – is a kind of regular visit to the dentist but for your startup.

If such measures are neglected, then over time you can face serious complications, which are way more difficult, painful, and more expensive to solve just like in the absence of normal accounting in the project.

At what stage should a startup start tracking financials?

The sooner you start, the easier it will be for you to start. Naturally, at the very beginning, all the efforts of the founders are spent on attracting new users and growing revenue, and these are undoubtedly the tasks of the first priority. But at the same time, the complexity of accounting in the new project and in a business earning hundreds of thousands of dollars is significantly different.

Most businesses are quite simple at the starting point and do not require hiring a separate person, for instance, an accountant or a financier, to close reporting issues from the very first day of the project’s existence. Of course, it is respectable to have a CFO on the team but for a project at an early stage it is much cooler to effectively attract clients and not enlarge the costs – investors will appreciate this much more.

Instead of hiring a separate employee, the project at an early stage may rather need the advice of a financier regarding reporting, model, fundraising, etc.

What to start accounting with and what should you strive for?

There are two fundamental approaches to accounting:

- Cash basis,

- Accrual basis.

The difference between them is the point when income and expenses are displayed in the reporting.

On a cash basis, revenue and costs are recognized upon receipt and disposal of money from the account. For example, the company has sold goods or services for $ 100, $ 70 came to the account, the rest is promised to be paid later so we display only $ 70 in the reporting.

On an accrual basis, revenue is recognized when it is earned (the product is sold, the service is provided), and costs are recognized when they are incurred (the service has been provided to you), regardless of the time the money is actually in or out of the bank. We return to the situation when goods were sold for $ 100. If we immediately received $ 70, and they promised to pay us $ 30 later, then with the accrual method we display the entire amount in the reporting at once.

The pros and cons of each method, where to start, and what to strive for.

You can start with the construction of reporting on income and losses (Profit and loss, aka P&L) on a cash basis. At this stage, we periodically collect bank statements and group them by the transaction. This method can be quite applicable at the very beginning – it shows how much money is actually in the company and what it is spent on. The main advantages of the cash method are simplicity in its maintenance and an accurate understanding of how much money is actually in the account.

But with simplicity, there is usually a lack of detail. For example, you can make a lot of sales in May but only get paid for them in June and not sell anything at all in June. Thus, in the reporting on the cash basis, June will look much more successful (a lot of money came in), although, in reality, it is not (there were no sales in June, and the money came in “May”).

Revenue earned ≠ Revenue received

Based on such data, you can make the wrong business decisions about the seasonality and sales efficiency of your business. The same goes for costs. As the number of customers, sales, customers, and contractors grows, the project should strive to move towards accrual reporting.

Returning to the example of sales in May and June, due to the fact that when using this method, revenue is displayed in the period when they were earned, and not received, we will be able to draw correct conclusions about the effectiveness of sales in May and their absence in June.

Investors are more interested in accrual reporting.

The main disadvantage of this method is the complexity of its implementation. In this case, you need to record who and how much owes you (the same $30 that they promised to pay later), as well as not forget about your own debts to others.

Also, accrual accounting can give a false sense of financial security, since you are taking into account the bills that have not yet been paid and it seems that all the $ 100 from sales are already waiting for you in the bank account, although in fact only $ 70 has come in, and $ 30 still needs to wait.

That is why in the transition to building financials tracking on an accrual basis, it is worth continuing to monitor the actual movement of money (on a cash basis), so as not to suddenly find your bank accounts empty and not start convulsive races.

Top-level is reached when the P&L (statement of income and loss) on an accrual basis and Cash Flow (statement of cash flows) is supplemented by a balance sheet (where we display assets – money, real estate, stocks, debts to us, and liabilities – our debts, loans and share capital).

This is high-quality reporting that most fully shows what happened in the business over the period. Having got to this stage, the project may really need its own financier in the team.

What do investors pay attention to in financial statements?

For an investor, reporting is an additional way of communication that helps to learn the history and assess the current position of the company. At the Pre-Seed and Seed stages, projects that are looking for funding often only need to show the P&L – a statement of financial results that reflects income, expenses, and profit (or loss) for the period.

P&L is more comprehensive about the financial performance of a startup when compiled on an accrual basis.

Startups are a story about growth and the money it takes to ensure that growth. Therefore, in P&L, investors pay special attention to the sales growth rate, the structure, and the number of costs required to support this growth.

The current unprofitableness of the project is not a problem if the amount of money that the user brings over the entire life period (LTV) is more than it was spent to buy it (CAC). But this is already a topic worthy of a separate article.

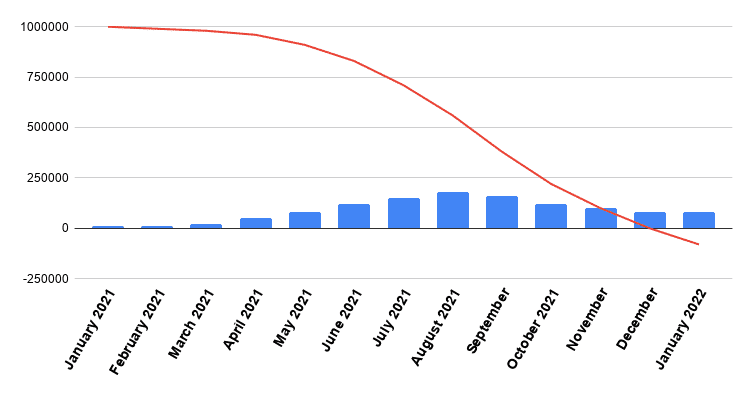

It is an advantage for a startup if its accrual P&L is accompanied by a cash flow statement. This startup financial gives the investor an understanding of the burn rate and runway of the project. In short, the burn rate is the amount of money a startup burns per month, and the runway is the period of time during which the company will not run out of money at the current burn rate.

These are quite important metrics for a business because they show how long a startup can live with the funds it has.

Another document that investors are interested in is the financial model. Unlike reporting with historical and current data, the model reflects financial goals and projections for the future.

Quite often, projects provide reporting in the form of a model, where the actual data is immediately followed by a certain forecast showing what heights the project plans to achieve in the future. An early financial model is an additional way to show that the team has goals and an idea of how to achieve them.

What tips will help founders to avoid financial accounting errors?

Working with startup founders, we understand the importance of focusing on the product, customers, and growth. But at the same time, we remind you that it is advisable to start keeping records at the same time as other important operations. Here are some tips to help founders avoid mistakes:

- Do not delay the start of accounting. The main mistake of financial reporting is its absence.

- Try to transition to the accrual basis as early as possible – as soon as you have a starting understanding of the financial situation. Further, supplement it with a cash flow statement and a balance.

- Learn the principles of financial modeling. For example, you can download a good report and predictive metrics template for your SaaS business from ForEnterpreners (https://www.forentrepreneurs.com/saas-metrics-2/).

- Take your time hiring a separate person to do your financial records. In the early stages, it may be useful to seek help from mentors or advisors several times for help, but complete and high-quality documentation at this stage is a feasible task for existing team members without a financial background.

- During fundraising, founders can rely not only on investment but also on professional assistance from representatives of interested investors, including help with issues of financial accounting and modeling.

We hope this article helped you to verify the need for accounting and get familiar with the types of financials for a startup, methods, and stages of building it. Feel free to share the material if you find it useful.